Table of Contents

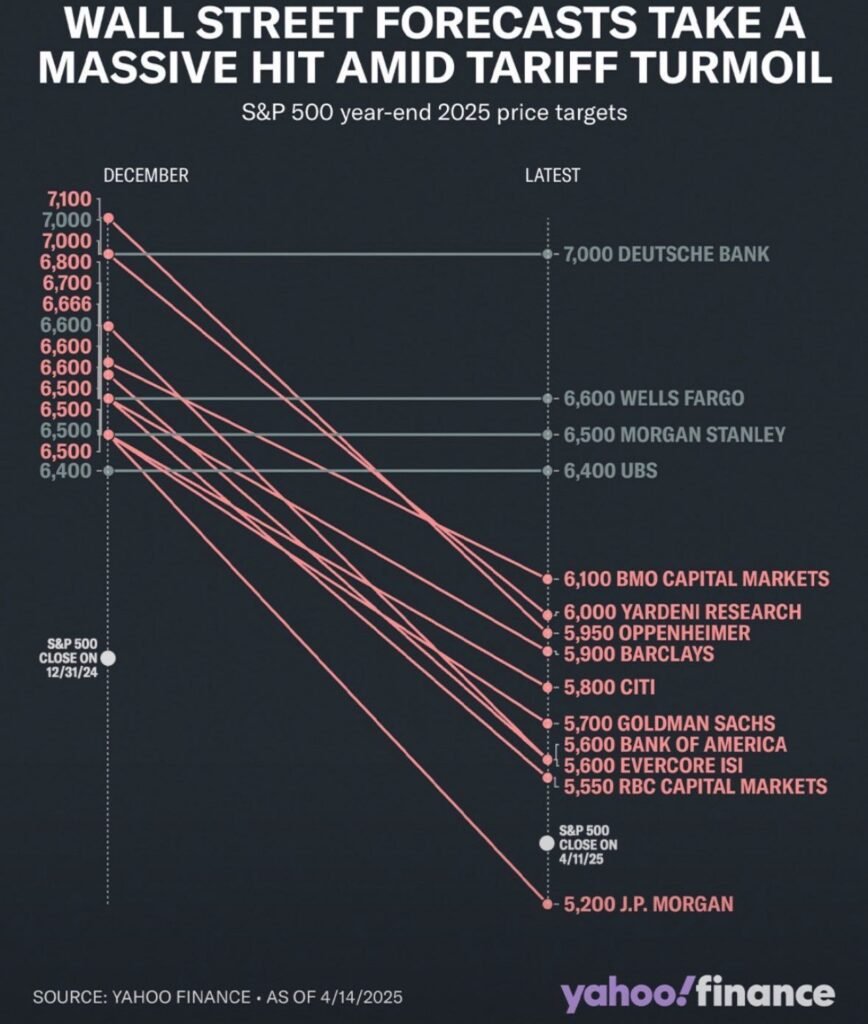

At the close of 2024, optimism dominated Wall Street. Most major banks were issuing bullish forecasts for the S&P 500, with year-end targets soaring between 6,500 and 7,100. But as 2025 gets underway, that narrative is quickly unraveling.

Historically, Wall Street has experienced periods of both exuberance and pessimism. For instance, the dot-com bubble of the late 1990s showcased how quickly sentiment can shift when reality diverges from expectations. Similarly, today’s market is facing its own set of challenges that may mirror past precedents.

These trade tensions have not only affected tariffs but also impacted supply chains globally. Companies that once thrived on international trade are now grappling with increased costs and logistical hurdles, making it imperative for investors to reassess their portfolios as these factors unfold.

Additionally, investor psychology plays a crucial role during such times. Fear often leads to panic selling, further exacerbating market volatility. Understanding behavioral finance can help investors navigate these turbulent waters more effectively.

Market revaluations can often precede major economic shifts. For example, in 2008, the financial crisis led to a reevaluation of risk and resulted in the creation of stricter regulations on financial institutions. Similarly, today’s market might face a reevaluation leading to new norms.

Source: Yahoo Finance

Understanding the historical context of risk pricing can provide valuable insights into current market dynamics.

Beyond geopolitical uncertainties, other factors are also at play in the current landscape.

The sharp shift in tone isn’t without reason. Rising trade tensions between the United States and China, along with the reintroduction of tariffs, have forced markets to reassess their assumptions. As a result, top financial institutions are adjusting their outlooks — and not in a good way.

These multifaceted challenges indicate that a cautious approach is warranted, with a focus on diversification and risk assessment.

The Importance of Research and Analysis

Investors should remain informed and vigilant, as knowledge is a powerful tool in uncertain times. Engaging in thorough research and analysis can help identify potential opportunities that arise amidst market fluctuations.

Utilizing analytical tools and resources can aid in making educated decisions. Many platforms provide valuable insights on market trends and performance metrics that can be leveraged for better investment choices.

Additionally, networking with other investors and professionals in the field can enhance your understanding of market dynamics and help you discover new strategies.

Long-Term Perspectives

Investing is not just about short-term gains; it’s also about building wealth over time. Focusing on long-term strategies can provide a buffer against short-term volatility.

Consider employing a dollar-cost averaging strategy, which involves investing a fixed amount regularly over time. This method can reduce the impact of market fluctuations on your overall portfolio.

Recent revisions tell the story. J.P. Morgan now expects the S&P 500 to end the year around 5,200. Goldman Sachs has lowered its target to 5,700, Bank of America to 5,600, and Citi to 5,800. Even UBS and Morgan Stanley, typically more upbeat, are adopting a more cautious stance.

By implementing these strategies, individual investors can better position themselves to weather economic uncertainties and capitalize on emerging opportunities.

Preparing for the Future

Markets are undoubtedly evolving, and adapting to these changes is vital. Investors should remain flexible and be willing to pivot their strategies as new information comes to light.

Additionally, actively participating in discussions about market developments can provide fresh insights and enhance overall investment strategies.

Conclusion: The journey of investing is invariably tied to adapting to market changes. Embracing a mindset of continuous learning and adjustment will empower investors to navigate uncertainty and seize growth opportunities in the ever-changing landscape.

This isn’t just a temporary correction — it’s a broader market revaluation. Investors, both institutional and retail, are being reminded that markets are no longer driven purely by earnings growth or economic momentum. The focus is shifting toward macroeconomic policy, geopolitical risk, and structural global challenges.

Why Risk Is Being Repriced

We’re seeing a fundamental reset in how risk is perceived and valued in the market. Several key forces are contributing to this:

- Geopolitical uncertainty: The renewed strain in U.S.-China relations is rekindling fears of trade fragmentation.

- Slowing global growth: Economic data points to deceleration across key regions.

- Reduced risk appetite: Investors are becoming more defensive, seeking shelter from rising volatility.

These trends are not short-lived. In fact, they suggest a long-term shift in how investors need to position themselves — not just in 2025, but beyond.

How Institutional Investors Are Responding

As the landscape changes, large institutional investors are adjusting their strategies accordingly. Many are rotating out of high-volatility sectors, reducing exposure to speculative growth stocks, and moving into areas of the market considered more stable.

There’s a clear tilt toward defensive sectors like healthcare and consumer staples. At the same time, we’re seeing a rise in cash allocations and a greater emphasis on liquidity. The message is clear: safety and flexibility are being prioritized over aggressive returns.

This shift isn’t fear-driven — it’s strategic. When the market enters uncertain territory, smart money moves first to protect capital.

What This Means for Individual Investors

If you’re managing your own investments, this is not a time to sit back. Risk management is no longer a luxury — it’s a necessity.

Here’s what individual investors should be doing now:

- Review your portfolio: Assess whether your holdings align with current market dynamics. Overexposure to volatile sectors could hurt you in a downturn.

- Ensure liquidity: Having cash on hand gives you options — to act on opportunities or to stay afloat during corrections.

- Build a resilient strategy: Diversify across sectors and asset classes, with a focus on capital preservation and long-term strength.

It’s also wise to revisit your investment goals and risk tolerance. What worked in the bull run of 2023 or early 2024 may not work in the more cautious environment of 2025.

Final Thoughts

Markets are sending a clear message: the game is changing. As risk is repriced and volatility rises, only those who adapt will stay ahead. Whether you’re a seasoned investor or just starting out, now is the time to reassess, reallocate, and rethink your strategy.

Success in this market won’t come from chasing returns — it will come from managing risk and staying informed. To learn how to identify the best stocks and make informed investment decisions, check out my eBook, How to Spot Winning Stocks in Any Market, where I share proven strategies and insights to help you thrive in any market condition.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Investing involves risk, and readers should consult a licensed financial advisor before making investment decisions.